December 21, 2022 | WEEKLY SECTOR ROTATION | Brian T. Hannon, CFA

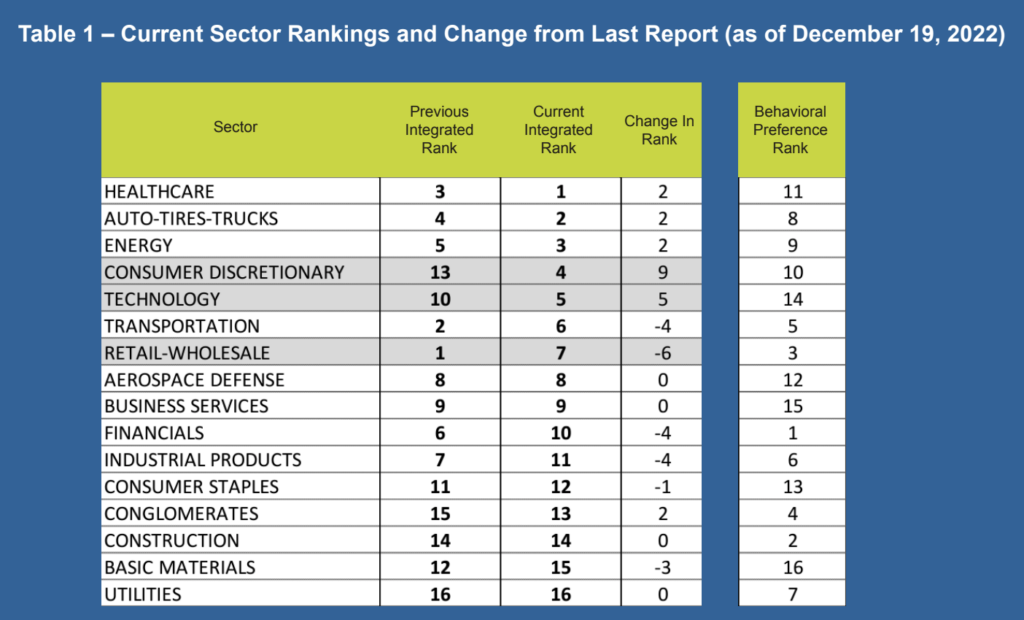

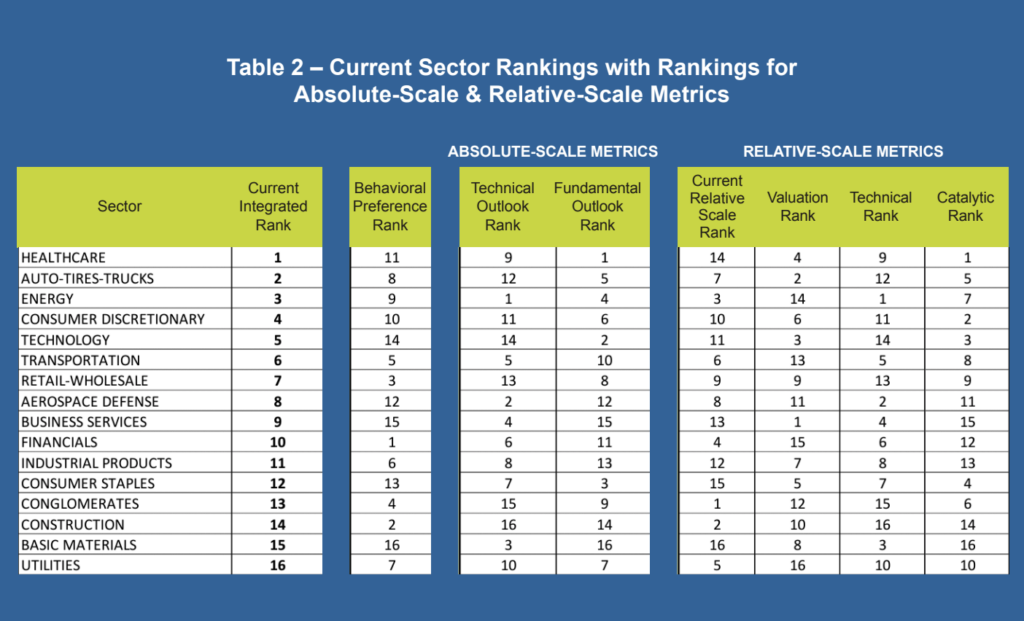

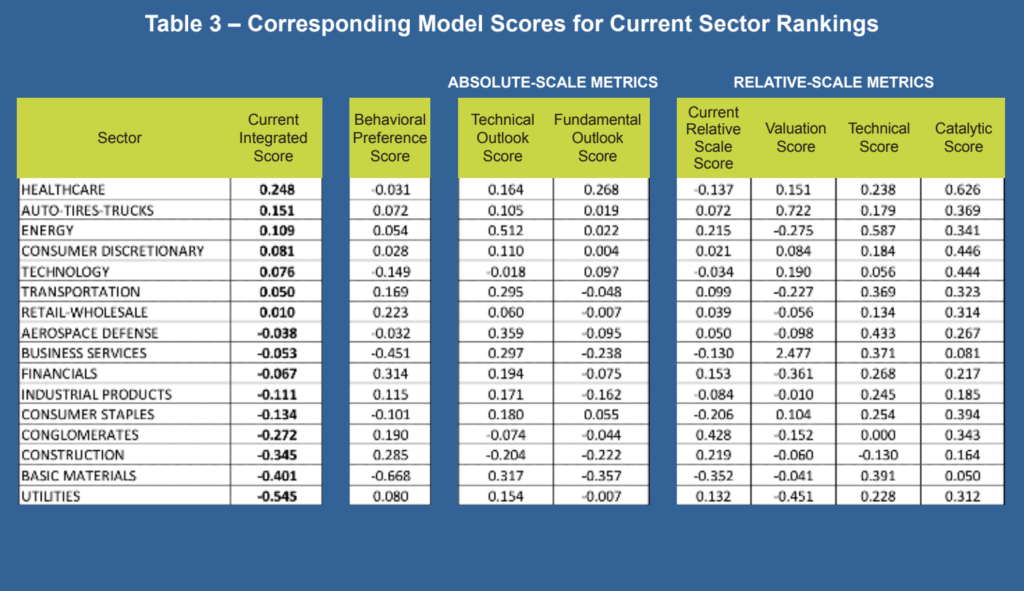

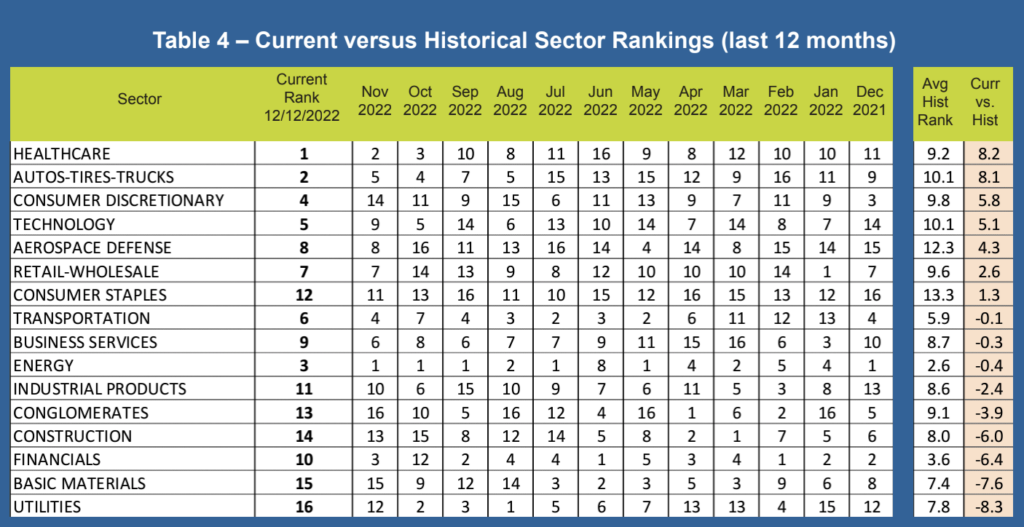

Improved catalytic and technical scores have helped the consumer discretionary sector to move

up from the bottom group to the top 5 group of our attractiveness rankings. Favorable behavior

preference has also contributed to this sector’s ranking move. In contrast, the retail sector has

slipped out of the top 5 group as catalytic properties deteriorated. We also note that improvement

in fundamental outlook scores has resulted in the technology sector moving up in our rankings.

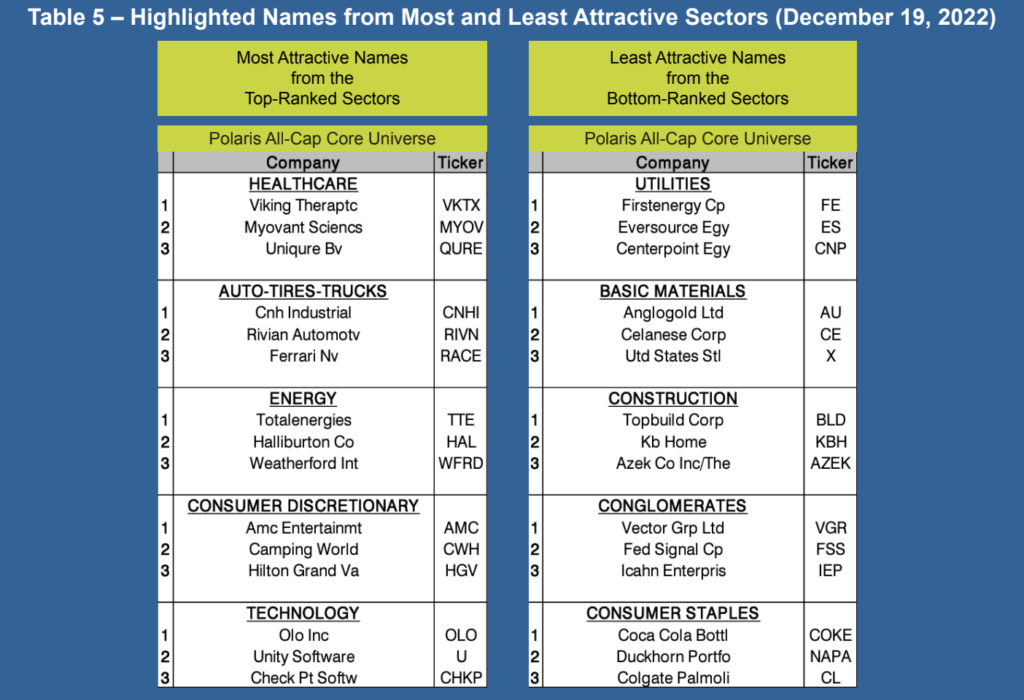

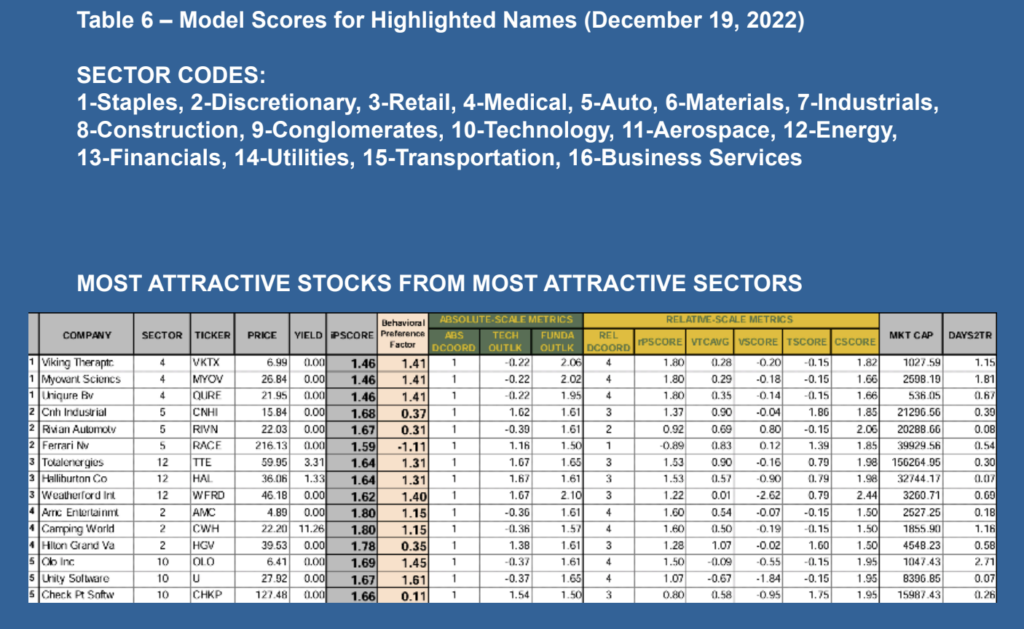

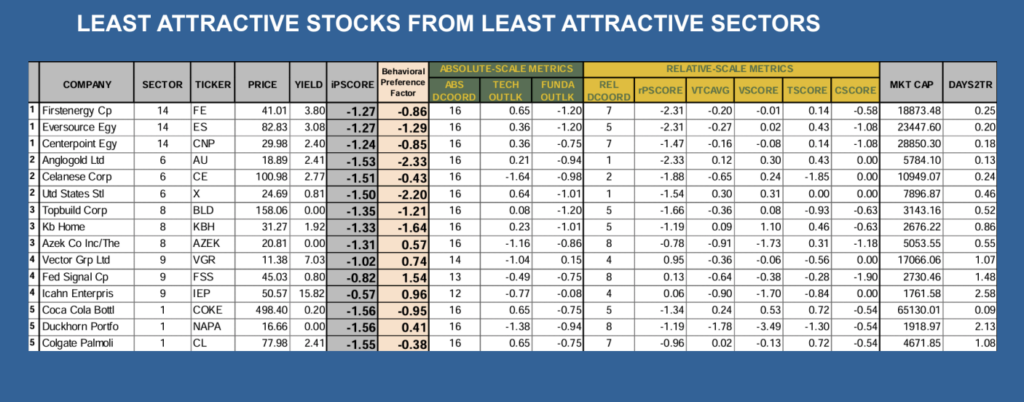

See Tables 5 and 6 for top-ranked names from the most attractive sectors and bottom-ranked

names from the least attractive sectors.

Brian T. Hannon, CFA

Founder, Director of Quantitative Equity Research

Qubit Research, LLC

With an academic background in engineering and economics, Brian Hannon began his career in the chemicals industry at the Dupont Company where he held various positions in research & development, project management, and corporate finance. An early indication of his innovative nature occurred while in R&D; as Brian was awarded a patent for his role in the development of a reverse osmosis process for purifying chemicals used in the production of semiconductor devices (Patent#4,879,043: Manufacture of High Purity Hydrogen Peroxide by Using Reverse Osmosis”).

Pursuing his interest in the stock market, Brian made the transition to the investment management profession as a research analyst covering chemicals industry companies at the DuPont Pension Fund. He subsequently joined ASB Capital Management where he originated the unique approach to structuring multi-factor models that Polaris is based on. Brian moved on to Macquarie Investments (formerly Delaware Investment Management) where he produced an exceptional track record while serving as a senior portfolio manager on the institutional large-cap value team. After Brian left Macquarie, he founded Qubit Investments, LLC to launch an equity market-neutral fund. The fund utilized an updated version of the Polaris multi-factor model, integrated with a systematic portfolio construction algorithm that Brian developed. He later became the director of equity research at Sturdivant & Co. and then Quoin Advisors, LLC, which was prior to his current role as founder of Qubit Research, LLC, an independent equity research boutique. Brian holds a BS degree in chemical engineering and a BS in economics from Carnegie-Mellon University. He is also a CFA charter holder.

DISCLOSURES AND DEFINITIONS

Qubit Research, LLC and its employees, officers, and members may participate as an agent in transactions involving the securities referred to herein (or options or other instruments related thereto), including in transactions which may be contrary to any recommendations contained herein. This publication does not constitute an offer to sell or solicitation to buy of any transaction in any securities referred to herein. Any recommendation contained herein may not be suitable for all investors. Although the information contained in the subject report (not including disclosures contained her in) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This publication and any recommendation contained herein speak only as of the date hereof and are subject to change without notice. Qubit Research, LLC and its employees shall have no obligation to update or amend any information or opinion contained herein. This publication is being furnished to you for informational purposes only and on the condition that it will not form the sole basis for any investment decision. Each investor must make their own determination of the appropriateness of an investment in any securities referred to herein based on the tax, or other considerations applicable to such investor and its own investment strategy. By virtue of this publication, neither Qubit Research, LLC nor any of its employees shall be responsible for any investment decision. This report may not be reproduced, distributed, or published without the prior consent of Qubit Research, LLC All rights reserved by Qubit Research, LLC This report may discuss numerous securities, some of which may not be qualified for sale in certain states and may therefore

not be offered to investors in such states. This document should not be construed as providing investment services. Investing in non-U.S. securities including ADRs involves significant risks such as fluctuation of exchange rates that may have adverse effects on the value or price of income derived from the security. Securities of some foreign companies may be less liquid and prices more volatile than securities of U.S. companies. Securities of non-U.S. issuers may not be registered with or subject to Securities and Exchange Commission reporting requirements; therefore, information regarding such issuers may be limited.