Menu

Written by: Christina Surowiec

The term power utility as used in this piece refers to retail purveyors of electricity service, in some cases combined with metered gas access. Deregulatory initiatives enacted in the 1990s transformed the US power utility landscape via a major reshuffling of roles and functions. Prior to deregulation, power service was treated as a “natural monopoly” fully regulated at the state level. Firms received a guaranteed return deemed fair on their operations and otherwise had limited business autonomy.

Deregulation initiatives enacted in many states during the 1990s necessitated structural change in asset ownership, access, and control. Specifically, legacy providers were forced to divest generating assets while retaining transmission and distribution (not a practicable divestment) as the stub of their original natural monopoly. Simultaneously, they became competing retailers, required to open their system to other power providers. “Customer choice” was the watchword, though touted benefits of lower consumer rates often failed to materialize.

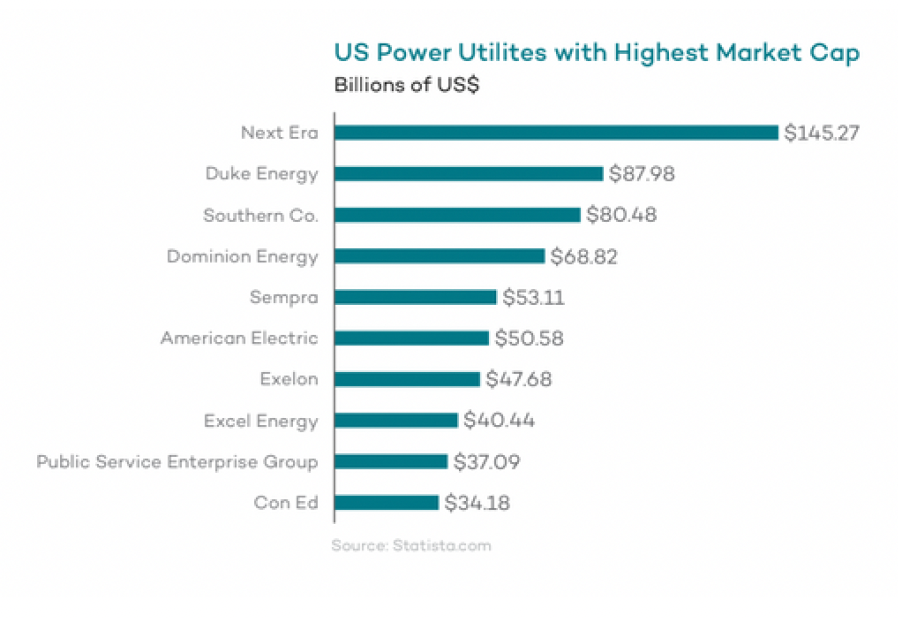

The three classifications of electric utilities in the US are investor-owned public corporations (IOUs), municipal utilities (“munis”) owned by local jurisdictions, and member-owned rural cooperatives. Altogether, about 3,200 electricity retailers exist in this country, but roughly 200 IOUs serving almost all major population centers account for a lion’s share of connections and revenues.

The graphic below shows the ten largest IOUs by market capitalization.

The (de)regulatory landscape is now a state-by-state patchwork juxtaposing deregulated, partially deregulated, and still-regulated regimes.

Deregulation, two decades into the experiment, has tracked a tangled course, studded with unintended consequences and ambiguous motives. While the process hasn’t been as smooth or complete as proponents envisioned or promised, nonetheless it radically altered the sector, especially in regard to wholesale markets. The trajectory we are on shows a pattern of:

Vertical integration, from power plant to customer, continues to exist in spots. But even in regulated states, many suppliers now purchase power from competitive wholesale markets.

US cities have enjoyed access to household electricity for over a century, while 1930s New Deal federal programs spearheaded electrification in outlying areas. By dint of long tenure, the nation’s power utilities comprise a mature industry. Yet, the physical and financial business of power provision is so bound up with issues of technological change, increases in scale, and environmental constraints that the characterization seems inapt.

Generating resources in the US are 80% privately owned. The federal government via entities such as Bonneville Power Administration (BPA) and Tennessee Valley Authority (TVA) is the other big player. Historically, federal power serviced mainly small resellers (munis and co-ops) in sparsely populated states, along with industrial installations sited explicitly for energy access. The interconnection of federal power with commercial wholesale markets is now rising on a case-by-case basis.

As purveyors of an essential service, the electric power sector cannot unyoke itself from compliance obligations on the regulatory/administrative front, amid limited clarity on how such compliance may be reconfigured over the medium term. Moreover, power delivery is evidently undergoing significant change to the physical supply mix and distribution infrastructure. While increasing use of renewables (wind and solar) is more or less baked in, national enactments backing them will really only help the US catch up with trends several forward-looking countries have been following for 10 or 15 years. Market forces also buoy renewables: at least sometimes, fossil power now clocks in as more expensive. Conversely, the cheapest available power, attainable without new Investment in generation, is that wrung from enhanced conservation and efficiency.

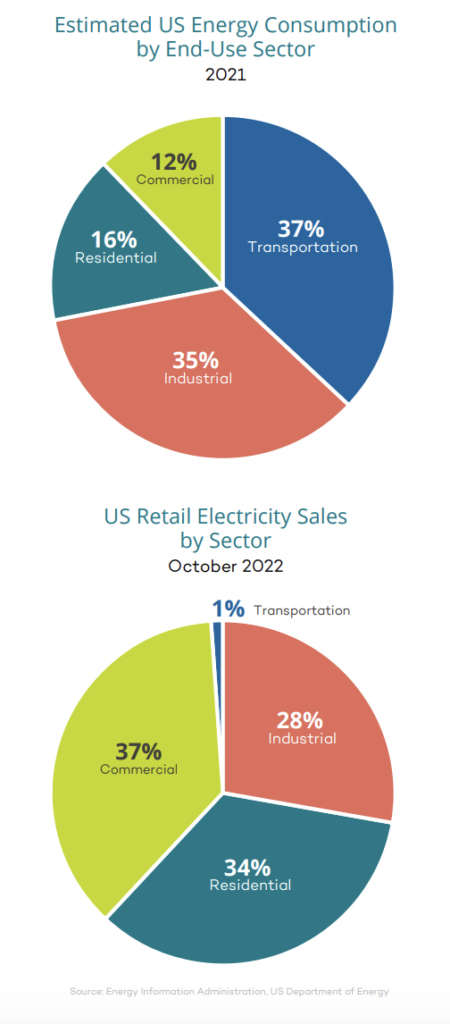

The above charts point to challenges ahead related to potential large-scale electrification

of vehicular transport. Energy consumption (top) encompasses all sources including fossil fuels, which figure in all end uses, e.g. heating furnace or boiler, gas appliances, but dominate in transportation. Electricity consumption would need to rise significantly to accommodate societal shift from petroleum to electrically fueled road traffic. Small 1% electric power share used for transportation at present mainly reflects city public transit systems.

The electrical grid is a product of accretion as opposed to master design. Both rising demand and deregulation effects focused attention on problems of managing interconnectivity. Sudden blackouts of New York City and much of the Northeast in 1965 and again in 2003 demonstrated grid vulnerability. Breakdowns can spiral dramatically under a rubric of long-distance transmission.

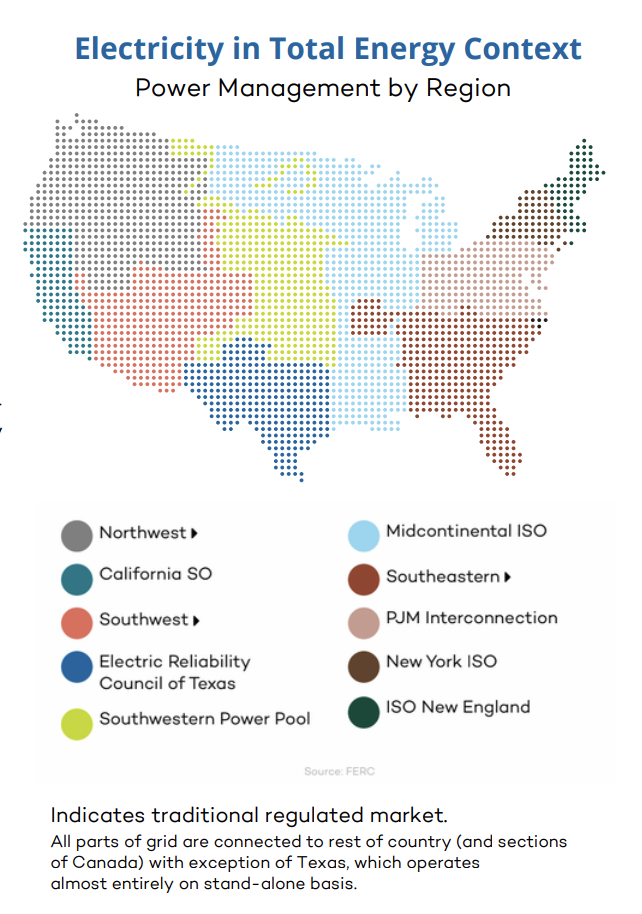

Bodies known as Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) gradually took on their present form in the 1990s and early 2000s. The map, opposite, shows their regional division. These agencies, formed under federal supervision but structured as fully independent, coordinate load management and the wholesale power market. Mandated to be nonprofit, neutral parties, they are funded by annual fees from power companies (generator to retail) in their area and possibly also a modest tariff on ratepayers. And, to the extent that Americans usually receive reliable electric service, these hands-on grid operators are the ones we should thank.

Measurements of generated versus used electricity will always show the latter lower, a reflection of transmission losses. High voltage lines minimize losses in long-distance transmission, but still deliver 2% less power than they start out with. Overall transmission losses are generally 4% to 6%, but in some situations have registered as high as 11%.

The US grid is relatively rich in north-south interconnections, but has far less capacity to move massive power loads in an east-west direction.

An aspirational scheme, tied to a serious ramp-up on renewables, would see superimposition of an entire new east-west grid supplemental to the existing system. The aim is to link solar and wind projects in desert and prairie states with power demand in faraway population centers. With a million legal, title, and financial details to be worked out, not to mention actual project design and siting, this undertaking will not get underway tomorrow, or next year. Still, the idea implicitly acknowledges oncoming transformational forces the energy sector must grapple with and try to master.

Smart grids, microgrids, mid-grids, and off-grid all percolate through conceptions of an electrified future. The home consumer will play a less passive role than had been customary. Various utilities have discovered that differentiated off-peak and demand pricing, given an informed customer, can shift load away from high- use times enough to reduce blackout or brownout risk. Power retailers increasingly engage in conservation promotion, through programs such as LED light giveaways, rebates on high-efficiency appliances, and free pickup of outdated home equipment. Even under ideal circumstances, lead time on new generation projects is long. Conservation and efficiency can effectively extend available supply right away.

In light of political controversies on one hand, and simple inertia (change is difficult) on the other, electric utilities face multiple uncertainties. These run the gamut from comparatively minor issues such as an end to Covid-related bans on shutting off delinquent accounts, to existential questions whether solar generation and electric cars will actually resolve the climate crisis. These observations suggest a guarded sectoral outlook. But electrification’s fully normalized status as an essential service acts as a positive counterbalance.

Quoin is a certified Minority-Owned Business Enterprise

© 2023 Quoin Advisors LLC

PHILADELPHIA – Headquarters

2005 Market Street, Suite 2030 Philadelphia PA 19103

CALIFORNIA – Branch

15233 Ventura Boulevard, Suite 500

Sherman Oaks, CA 91403